The basic principles: Just how can lenders works?

Mortgage brokers, and additionally commonly known as mortgage loans, allow it to be people to acquire a property by taking out that loan which money their brand new domestic. Mortgage brokers are specially available for to acquire a residential property, however they share of a lot similarities together with other brand of money. One particular parallels is that the people taking out fully the brand new mortgage commonly use a specific amount, and pay-off an arranged interest rate more a number of ages. Home loans supply the advantage of providing property consumers a funds treatment to pay for a massive a residential property buy. In this post, we’re going to check how mortgage brokers really works.

Contained in this Guide:

- Home loans: Just how can they work?

- Tips be eligible for a home loan

- Which are the different varieties of mortgage brokers?

- How can i get the best mortgage package?

Home loans: Just how do it works?

When you take away a mortgage, you are borrowing from the bank funds from the lending company to cover the purchase regarding a home. That implies the financial institution will pay the price into provider, and after that you agree to pay off the sum of toward financial, in addition to appeal which was consented. All the associated terms and conditions of your house mortgage tend to be defined on the arrangement you sign on recognition of your home application for the loan. Always, maximum cost period in the event that thirty years. In such cases, month-to-month money is short in comparison to quicker-name fund, like auto loans.

Ideas on how to qualify for a home loan

All the financial get lowest conditions that need as fulfilled by the those individuals using. This type of conditions typically can consist of money requirements, at least credit rating, and direction regarding bills. A smart initial step https://speedycashloan.net/loans/list-of-online-payday-lenders/ is usually to discover what the fresh new maximum value of the borrowed funds your qualify for try, and you may do this from the conversing with property loans consultant, that will workout brand new figure according to the income out of you, and you will somebody, if the appropriate. Typically away from thumb, we provide an annual installment amount to arrive at 31 percent of monthly money. Because thread has been recognized, the speed would-be calculated in accordance with the property’s field really worth and the mortgage proportions.

What are the different varieties of lenders?

Among well-known mortgage items that you will definitely select in the industry is actually availableness ties, that allow the latest borrower in order to withdraw more income that they has actually paid down, should they want to buy; collateral release securities, which allow you to take out the cash which is tied up of your house (usually while over 55); first-time securities, designed for the individuals taking with the assets hierarchy with the basic time; and focus-merely securities, by which customers are allowed to expend just the desire for the the financing, rather than paying down the main city, paying the borrowed funds just like the home loan term comes to an end.

Different kinds of mortgage brokers bring different types of interest, along with capped attention, and that suppress the eye of ascending more than a particular speed, however, really does allow debtor to benefit out of rate of interest dips in the industry; fixed attention, where rate of interest is restricted having an appartment period such one to, around three or five years, prior to reverting towards the fundamental variable price; cutting notice, and this observes the pace lose given that complete amount hence you borrowed falls; and changeable attract, that have an unfixed rate of interest that is modified more than a particular level.

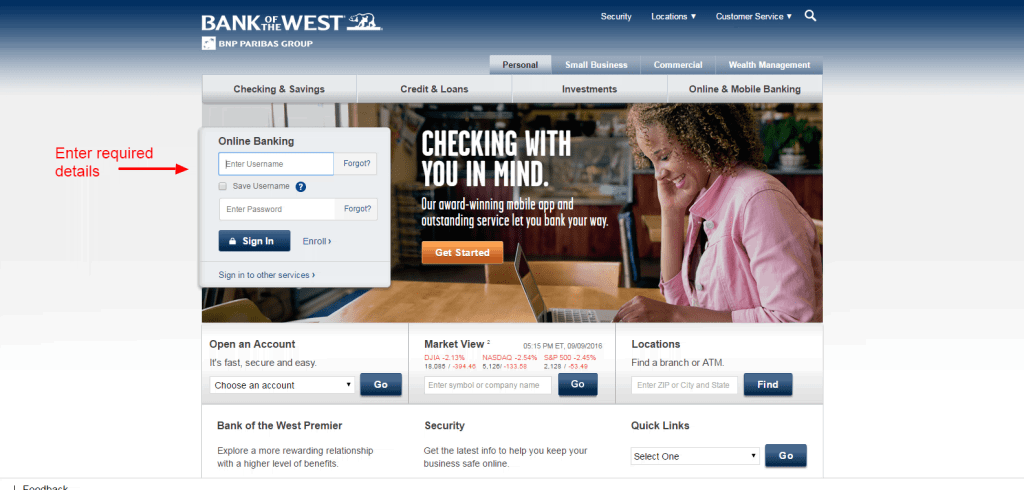

Throughout the digital time, there’s never been a better time to find the appropriate financial price for your requirements. This is because there is certainly an entire band of gadgets at your convenience, and internet such as for instance ours that allow one to contrast household money. You can weigh up most of the details and you can evaluate various prices to discover the most affordable mortgage brokers, and the ones which can be most suited toward future financial objectives. As an alternative, you can search this new professional help off a mortgage consultant so you can opinion the house loans being accessible to your, also to fill in your residence application for the loan.

Whichever route you’re taking to finding an informed home loan, remember – there is no need so you’re able to rush! By firmly taking care and you will planning, you’ll find a package which can only help to arrange your following.

So much more Items

- Broadband

- Car insurance

- Life insurance policies

- Home insurance

- Scientific Assistance

Save money. Convenient than ever before.

Our company is Currency Expert, the pros along with your fund. I contrast locations throughout the SA and you can enable you to get great prices, whatever the.

No Comments