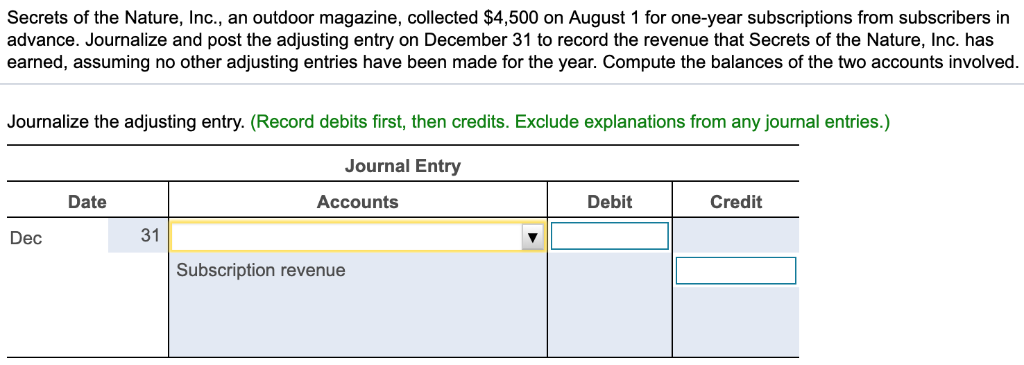

That could be good if the credit history are 640 or large

The shared LTV proportion compares the bill of mortgage and you will their HELOC together with your residence’s worth. In case your house is valued at the $150,100000 and you are obligated to pay $75,000 on the home loan, and you require a beneficial $29,000 HELOC, who does give you a combined LTV regarding 70% ($75,100 + $30,100 = $105,100000, that’s 70% away from $150,000). If your credit history is leaner, your ount.

Refinancing mortgage

Refinancing mortgage happens when you change your latest mortgage with an excellent new one loans in Gordonville. Homeowners can get refinance to switch the new terms of its mortgage otherwise to take out cash.

Imagine if you owe $75,100000 in your financial and your house is well worth $150,100000. You really have one or two choices for refinancing. If you want to decrease your monthly mortgage repayments, you could potentially re-finance your $75,000 balance which have an excellent $75,000 29-season fixed-speed mortgage. If you wish to supply a few of your residence equity, you could potentially refinance having good $one hundred,one hundred thousand 31-seasons fixed-rates home loan. During the closure, might located $twenty-five,100.

Profile also provides 29-seasons repaired-price mortgage refinances. This is why your loan is actually paid back more thirty years and your rate of interest never ever change. That implies their percentage constantly stays a similar. not, this does not include escrow payments for taxation and you can insurance policies, that may change.

Average Months to close Loan

Contour HELOC now offers closings for the only 5 days. You might complete the 1st app on line within 5-ten minutes, and you might usually know instantly whether or not you’ve been acknowledged. To possess Financial Re-finance, you could complete the initially software online in approximately ten minutes and can close-in a question of weeks.

Having HELOCs, Profile spends an automated Valuation Design (AVM) to assess the property’s value which means you won’t need to wait to own an out in-person appraisal. They bases its decision into the equivalent transformation, personal investigation suggestions and styles on the regional housing marketplace. To own financial refinances, Figure work with you so you’re able to plan a call at-person appraisal together with one checks.

After you have been accepted, nearly all Figure’s HELOC readers can work that have one of their eNotaries. The eNotary verifies your own term and you will reviews your posts with you, that you’ll indication electronically. Not all the counties make it eNotaries, not. In that case, Shape are working to you to prepare an in-people notary fulfilling.

To own financial re-finance, Shape deals with you to agenda an in-person closing at home or a place that you choose, dependent on what exactly is desired where you live.

Shape Credit score Lowest

Your credit rating are a good step 3-finger matter one to summarizes how well you pay right back financial obligation. Results range between 3 hundred to help you 850, and you may a get off 700 or more is recognized as a beneficial. Lenders normally have at least credit score. While beneath the minimal, you will need to take some time to switch their get prior to you could potentially qualify for financing.

Figure’s credit history lowest to possess home loan refinances are 620. The credit history minimal to own HELOCs is 640 (720 getting Oklahoma for both things).

Figure has obligations-to-earnings (DTI) proportion conditions. Their DTI ratio compares the monthly debt repayments toward pre-income tax earnings. Can you imagine you make $5,one hundred thousand per month prior to taxation along with $2,100000 per month within the month-to-month personal debt money, that has your mortgage repayment, your Figure loan payment, charge card payments, vehicles money and you will education loan payments. This provides you a good 40% DTI ratio.

Contour means men and women making an application for a beneficial HELOC getting a beneficial DTI proportion away from 50% otherwise faster, and in many cases, you prefer a beneficial DTI ratio away from 43% otherwise smaller. To have refinancing mortgage, you desire a DTI ratio from 43% otherwise quicker.

No Comments