Need consolidate loans? Listed below are some these types of financing alternatives

The good news is, consolidating your financial situation may help simplicity the process. In debt integration , you fundamentally roll your stability to the a single mortgage, streamlining your instalments and you may, ideally, cutting your total notice can cost you, as well.

Are you having difficulties dealing with multiple costs? Find out if you be eligible for a free debt relief session playing with this simple on line unit.

What is debt consolidation?

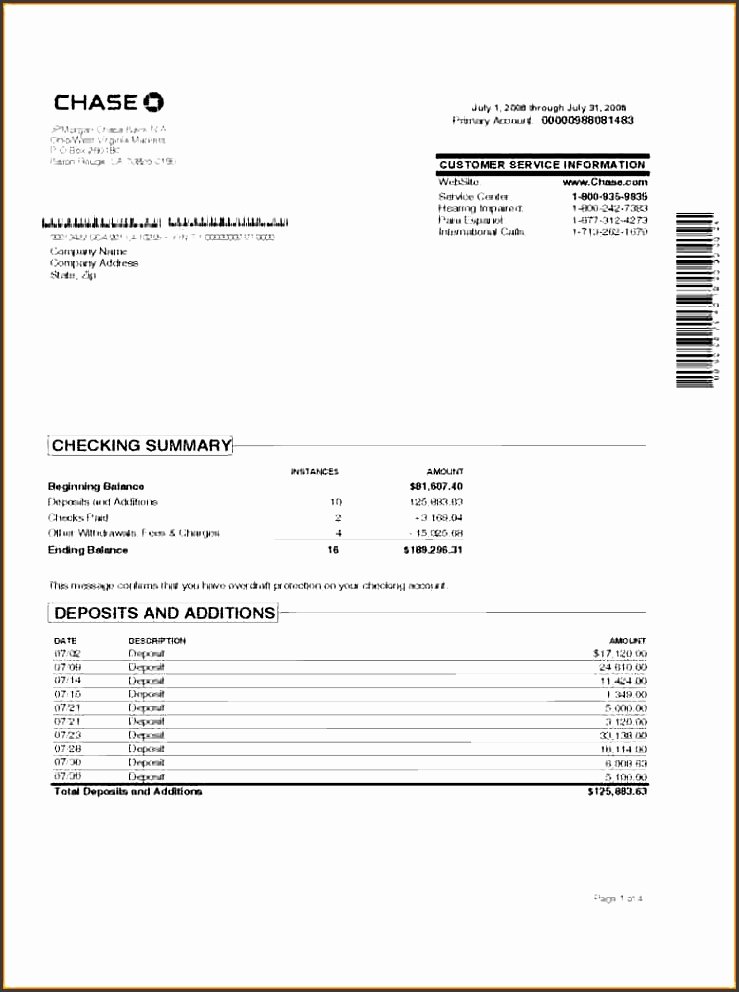

Debt consolidation happens when you combine all expense to your you to unmarried mortgage. You’re taking away a loan otherwise personal line of credit large enough to cover the balances toward all your valuable debts. Shortly after recognized, you employ those funds to pay off the handmade cards, financing or any other expenses completely. You are then kept in just the loan plus one solitary payment.

Debt consolidating loans will likely be recommended when you find yourself coping with credit card debt, while they will come with all the way down rates of interest. Handmade cards routinely have double-fist APRs, so consolidating playing with that loan or any other product are able to keep you both month-to-month and also in the long run. See just what choice may help you cut more money today.

Options for debt consolidating loans

There are a few options for combining your debt. Most are reserved just for property owners otherwise those with a home loan, and others can be utilized by people individual.

- A consumer loan:Signature loans should be a choice for debt consolidation reduction, as you’re able utilize the money the objective. They might come with high interest levels than many other integration selection, whether or not. An average rate for the signature loans is around 9%, with regards to the Federal Set-aside Bank out-of St. Louis.

- An equilibrium transfer charge card:Balance import cards was handmade cards that routinely have a beneficial 0% Annual percentage rate getting between six and 21 days. Your import all your valuable balance to the cards (there was constantly good step three% in order to 5% fee) immediately after which pay back the bill just before one to zero-price period ends. Based on credit bureau Experian, your generally you want about a beneficial 670 credit score or more to be eligible for one of them.

- A house equity mortgage or HELOC: For folks who own a home, you need to use a home guarantee financing or home security line away from credit (HELOC) to combine your financial situation. Speaking of both next mortgages that allow you to borrow secured on your residence guarantee. Domestic equity money come with an initial lump sum payment, when you are HELOCs work more like playing cards, which you yourself can withdraw from as needed.

- A profit-aside re-finance: That is an alternative choice to own residents. So you’re able to combine personal debt having a profit-away mortgage re-finance , you are taking out an alternative financing big enough to cover your own most recent harmony, together with your most other expense. Just remember: Discover upfront costs to help you refinancing. Home loan pick Freddie Mac computer prices this type of average around $5,100, though you could probably roll her or him in the mortgage balance and you may pay them from over time.

- An https://clickcashadvance.com/personal-loans-tx/dallas/ opposing financial: Having home owners out of a particular ages (62 and you will more mature) a contrary home loan can be used to reduce otherwise eradicate one a great loans. A contrary mortgage lets earlier owners with totally paid off (otherwise paid most of their mortgage) to get a portion of the house’s guarantee. This will be considered given that taxation-totally free income. It must be reduced, yet not, in the event your homeowner becomes deceased otherwise elects to sell your house. However money can help pay off higher-notice personal debt it may be really worth pursuing . Communicate with a mortgage professional to determine should this be the best roadway for your requirements.

Qualifications criteria for each and every of them choices relies upon the bank or mastercard team you use. You can expect your credit score to tackle a job, whether or not (and you can typically, the better the score is actually , the better rates of interest you can easily qualify for).

“Fundamentally, you want good credit in order to be eligible for a debt settlement financing which have positive words,” claims Leslie Tayne, a debt settlement lawyer during the Nyc. “You’re in a position to be eligible for a leading-notice unsecured loan which have marginal borrowing, but taking right out financing may not alter your financial predicament.”

If you combine your debt?

It may be smart to combine your debt if the you may be having difficulty keeping track of your repayments or you can slow down the overall focus you are able to shell out ultimately.

Just remember that , you’ll find risks in order to taking out fully any loan or personal line of credit. Having mortgages and you may house equity products, you’re borrowing against your residence. This might place your assets vulnerable to property foreclosure for folks who neglect to build payments. Failing to build money to your people mortgage otherwise credit card commonly as well as hurt your credit score, therefore definitely just borrow what you would like.

Because Tayne places it, “Merging your debt would not boost possibly tricky spending habits. If you have a tendency to save money money than simply you make, the odds are good which you’ll rack right up a whole lot from credit debt once again – maybe before the combination loan is paid back.”

No Comments