Hometap Comment : Try Hometap Wise?

Affordability

- Zero monthly installments

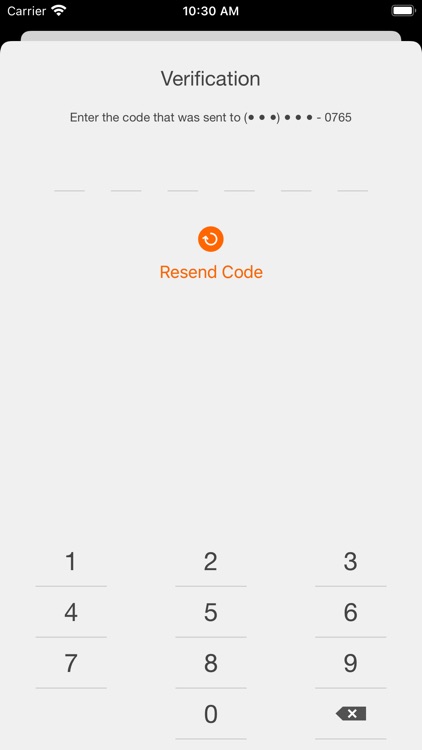

- Digital application and you can contracts

- No effect on credit history

- Is cause you to sell your property just after 10 years

- Can cost over a house security mortgage

- Limitation cash is lower than a timeless domestic collateral financing

If you have guarantee built up of your home and need access to dollars, you’ve got a few options. You might sign up for a property collateral personal line of credit, also known as good HELOC, explore bucks-out-refinancing mortgage, or promote a percentage from possession on your own home’s well worth so you’re able to a family particularly Hometap.

Hometap Brings Replacement Finance To gain access to Domestic Equity

You reside is probably the largest and more than worthwhile asset you will previously own. Over time, it remains more valuable because you spend the home loan once the real estate market close by knowledge general develops. This Hometap remark will help you to determine if having fun with Hometap to availability the oriented-right up collateral can be helpful or otherwise not.

Opposite Mortgages And Home Equity Money

Once the 1986, domestic equity finance have been offered, and more recently, earlier homeowners can enjoy opposite mortgages. For most residents, such commonly an effective alternatives. So you’re able to qualify for a house collateral mortgage, you must satisfy lowest credit history requirements and you can income standards.

Self-working some one may find it particularly tough to file brand new needed earnings to qualify. Taking on a property equity mortgage also means with significantly more loans, and that accrues notice and requirements a monthly payment. For cash-secured home owners, this could do even more difficulty.

Cash-Out Re-finance Solution

A funds-aside re-finance are an alternative choice to a home guarantee financing, however, so it once more mode boosting your complete obligations. Generally speaking this type of financing are carried out when the homeowner can down their interest rate, but depending on how much cash you take out, you might be against big monthly installments more an amount longer period of time.

Contrary mortgages is going to be recommended to own old property owners just who should remain in their homes but require residence’s dollars worth today. This type of finance are available merely to property owners who will be about 62 years of age and certainly will be pricey to prepare. However, there are not any monthly installments, and also the opposite mortgaged comes with getting settled through to the house is sold or perhaps the resident can no longer inhabit the house.

That have both a standard domestic guarantee mortgage (HELOC) and money-aside refinancing mortgage, you run the risk away from losing your home in order to foreclosure in the event that you simply can’t retain the monthly premiums.

Family Security Investment Companies

To have home owners who don’t meet the criteria getting a home equity mortgage, cash-out refinance or contrary mortgage, the capability to availability its residence’s equity try nonexistent up until now. Today homeowners could work that have domestic equity funding businesses, for example Hometap, to utilize the fresh new guarantee in their home to discover the cash they require without worrying throughout the being qualified for https://paydayloanalabama.com/hytop/ a financial loan or taking on most obligations.

Along Happens Hometap

Jeffrey Cup and you can Maximum Campion are one another enough time-big date entrepreneurs whom seem to look for traders to assist grow its enterprises. In exchange for a portion out-of possession, these traders deliver the capital had a need to grow and you can build they. The pair started to consider a way that it exact same idea is put on homeownership.

Inside the 2017, the team oriented Hometap, a house guarantee resource organization based inside Boston, Massachusetts. Performing first-in six says and later expanding to a dozen, Hometap even offers yet another alternative for opening your own home’s collateral.

Doing work very much like a corporate investor does, Hometap will bring homeowners that have a cash commission away from a portion of the collateral in return for a percentage of the property ownership. New resident will get the amount of money they need to pay back other debt, remodel and you can boost the home, otherwise pick an alternate house.

No Comments