Clarifi was coping with RRR clients remotely

- Improved maximum loan amount regarding $fifty,000 away from $twenty four,999

- Construction several months lengthened so you’re able to 1 year out-of 3 months to let residents more time to get top quality designers and have the works complete

- Elimination of requirement for mortgage pre-approval; website subscribers commonly apply privately for a loan when they try considered qualified of the Program Navigator and also have acquired property evaluation

- Removal of importance of a comprehensive performs range before loan approval; replaced because of the 1) home review and dos) Program Navigator oversight out of financing pulls

- Capability to spend builders up to 50% from estimated prices upfront rather than 29%

Univest Financial and you will Believe Co. is actually thrilled towards relaunch of the Repair, Resolve, Replenish program and you will pleased in order to once more getting providing given that a lending spouse, told you Dana Brownish, Chairman away from Individual Qualities to possess Univest. Univest try seriously interested in offering back and a good way i would which is by the support applications and you can organizations which might be and make a great difference between local groups across the area. For the significant changes on the RRR system, i look ahead to providing bring sensible economic options to even so much more Philadelphia people.

Just like the a financial dedicated to the folks we serve, we need higher pleasure from inside the giving services that will help you our very own people doing its monetary wants, told you Steve McWilliams, Industry President to possess Urban area Philadelphia, Republic Financial. Home ownership and you will sensible domestic solutions is actually critical elements of lifting up some body and teams, and we have been recognized getting one of several lenders giving support to the city’s refurbished RRR program.

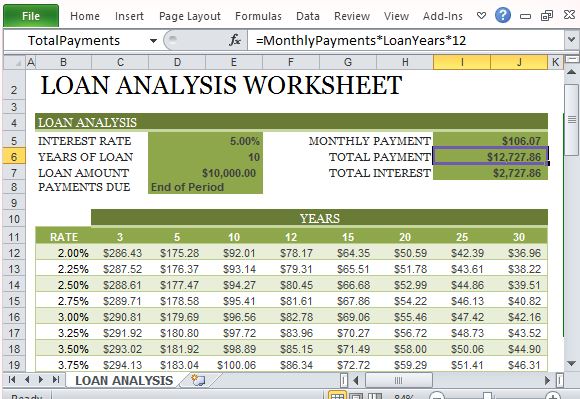

Heal, Resolve, Replace is an initiative of the Town of Philadelphia to simply help Philadelphia property owners access lower-notice money to find its attributes. Lenders doing the application are offering 10-seasons, 3% fixed Apr money you to are normally taken for $dos,five-hundred in order to $fifty,one hundred thousand to qualified people. Restore, Resolve, Renew finance can be finance various home repairs one to attract for the health, coverage, weatherization, the means to access, and you will lifestyle. The intention of the application form will be to help Philadelphians improve their belongings and you will reinforce their organizations.

The new Yearly Declaration for RRR have our successes, along with here is how this choice functions and just why the main thing.

Who’ll use?*

Whose first household need solutions Which have fico scores a lot more than 580 Whom is actually cutting-edge into societal resources and taxes otherwise is into the an installment bundle for the Town Who do not have L & I violations or commonly eliminate abuses within the system That home insurance.

* Most underwriting (lowest eligibility) criteria: Individuals should have a loan-to-value ratio at the otherwise less than 105% of immediately following-treatment really worth and you may an in the past-stop obligations-to-earnings proportion on or below 43%.

Just what properties are offered?

Let choosing when you are qualified to receive the application Receive financial guidance Assist pinpointing easy bad credit loans in Telluride expected solutions Link you to definitely a playing bank Assist seeking a company Assist applying for the loan

Exactly what solutions meet the criteria?

Solutions, developments, and you will upgrades associated with health, cover, and standard of living Roof, siding, base, and masonry Sidewalk and garage resurfacing/substitute for and you can additional stair repair Screen and you will home repair and replacement for Changes that allow to own smoother usage of and you can versatility within a domestic Accessories, plumbing, sewer and you may waterline repairs and replacements Hvac program and you will hot water tank fix otherwise replacement Electric fixes Solutions pertaining to lead-centered decorate Mildew and you will radon mitigation

This program and the standards and you may criteria thereof tends to be subject to coming amendment.. The decisive conditions and terms of any financing offered underneath the program will be set forth within the fully conducted mortgage documents. Unless and you may up to for example loan data files try fully done, truth be told there might be no contractual obligation into financial(s) to include any mortgage nor shall truth be told there end up being any accountability after all anywhere between and you can among the PRA, the lender(s) and you can any homeowner seeking to a loan in system.

No Comments