Home owners Having fun with HELOCs to cut Property Will set you back

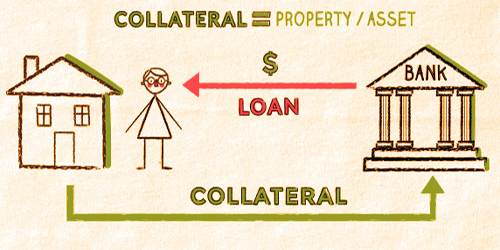

Which have inflation interacting with a beneficial 40-12 months large in summer, 70% of respondents still imagine themselves extremely or quite economically stable. However with proceeded financial and you can ericans try investigating a means to slash way too many costs and you will pay down one highest-focus bills. Family equity lines of credit (HELOCs) and you will home guarantee financing might be a relatively low interest rates means to gain access to collateral crafted from owning a home. This can be despite having an interest in home improvements otherwise debt consolidation reduction.

“Of numerous People in the us do have more security within their residential property than in the past, thus utilizing it on their virtue will make financial feel,” said Jon Giles , Direct from Individual Direct Lending on TD Financial. “When put responsibly, HELOCs and you may family security finance are effective, affordable products that assist in paying high interest obligations, covering degree will set you back or enabling house home improvements, and this incorporate worthy of on property.”

A current survey of TD Lender unearthed that nearly 90% out of respondents expressed a rise in collateral once the to buy their property, but a lot less are preparing to tap into so it prospective supply regarding fund within the next eighteen months

Particular 65% regarding members that have any financial obligation apart from their financial expressed they will want to consider merging specific otherwise all their financial obligation not as much as less interest rate mortgage, which have 47% watching it as the utmost crucial trait of their debt consolidating tactic. And even though HELOCs and you can domestic collateral finance routinely have down appeal cost than just of a lot unsecured loans, a third (33%) of these who have personal debt except that their home loan consequently they are shopping for consolidating it on a lower interest, become basic otherwise embarrassing performing this using their domestic because an excellent guarantee. Indeed, 43% of these participants prefer to use an unsecured loan. This might mean a space in the knowing the benefits associated with tapping into the family equity.

“Customers should consider their own financial situation and you can speak with a lender basic whenever exploring options to utilize house guarantee,” told you Steve Kaminski , Direct away from Home-based Financing at the TD Financial. “Loan providers can help borrowers know what activities line up and their monetary desires, their latest equity height and exactly how they thinking about utilizing the money. They are going to in addition to make sense of the modern markets so that you is understand what your payments will such as for example and exactly how they changes predicated on the present interest ecosystem.”

If you’re debt consolidation has been important for most, the kind of debt homeowners hold varies. New questionnaire found that 69% regarding users who have any personal debt aside from the mortgage have personal credit card debt one of many highest interest classification having borrowers. Other types from loans of these respondents become car and truck loans (43%), unsecured loans (32%), student loans (27%), and you may nearly one in 5 (19%) possess scientific obligations.

Renovations will always be perhaps one of the most popular purposes for HELOCs and you may family guarantee fund. In reality, 43% from respondents that considered otherwise already renovating their house intend to utilize a good HELOC otherwise domestic equity loan for their renovation strategies. And gives chain challenges aren’t preventing desire getting customers. Seventy-eight percent ones exactly who detailed rates because their concern inside their restoration however intend to move forward. And you will nearly 50 % of (49%) of these which detailed full will set you back as their consideration nevertheless want to move on having home improvements due to the fact labor and gives strings shortages complicate the procedure then. Kitchen areas had been widely known space/town to upgrade (55%).

“Because people pick versatile https://paydayloancolorado.net/pine-valley/ financial loans in order to power its restoration ideas, domestic equity finance and you can HELOCs are perfect options to consider,” told you Kaminski. “HELOCs, particularly, provide by themselves so you’re able to independency with borrower’s ability to draw financing since expected. With have strings disruptions and you can ascending rising prices carried on to affect the total cost of household home improvements, liberty could be key in accessing money about processes.”

Although not, more than half (52%) out-of people who in past times had a beneficial HELOC otherwise family security financing otherwise never ever performed but know very well what it is consider by themselves maybe not whatsoever or not likely to think trying to get both within the next 18 months

Because the repair will set you back rise, the majority are along with provided perform-it-oneself plans whenever tackling home repairs. The analysis found 42% regarding respondents that happen to be believe otherwise already executing domestic renovations often get professionals to-do the really works, when you are various other 36% intend to do a bit of of one’s works themselves and you will hire an excellent elite some other employment.

No Comments